Airwallex Review: The Smart Way for U.S. Businesses to Manage Global Money and Scale Faster

Managing global finances shouldn’t slow your business down. For U.S. companies expanding internationally or operating across borders, Airwallex has become a trusted financial platform that replaces outdated banking systems with speed, transparency, and control.

From startups and e-commerce brands to SaaS companies and enterprises, Airwallex empowers businesses to move money globally, reduce costs, and operate with confidence — all from one powerful platform.

What Is Airwallex and Why U.S. Businesses Choose It

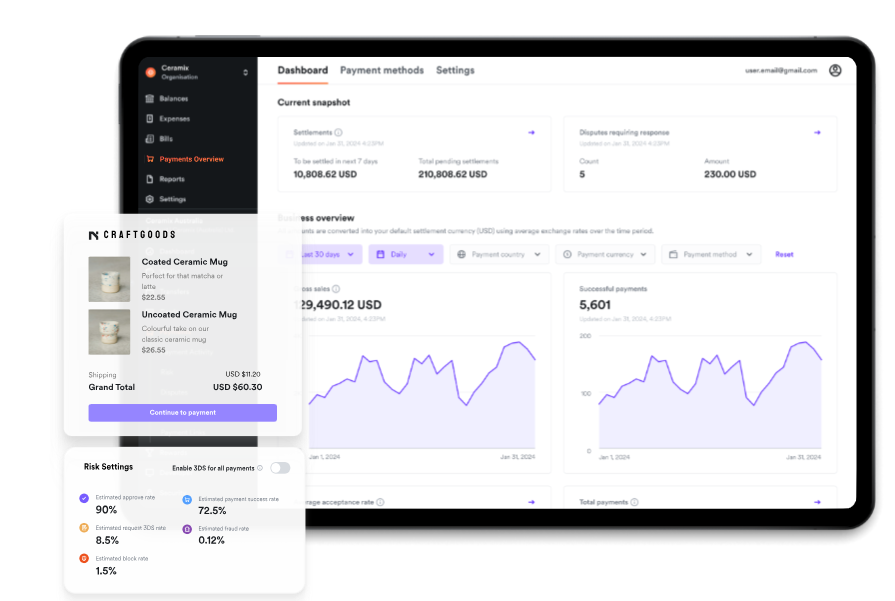

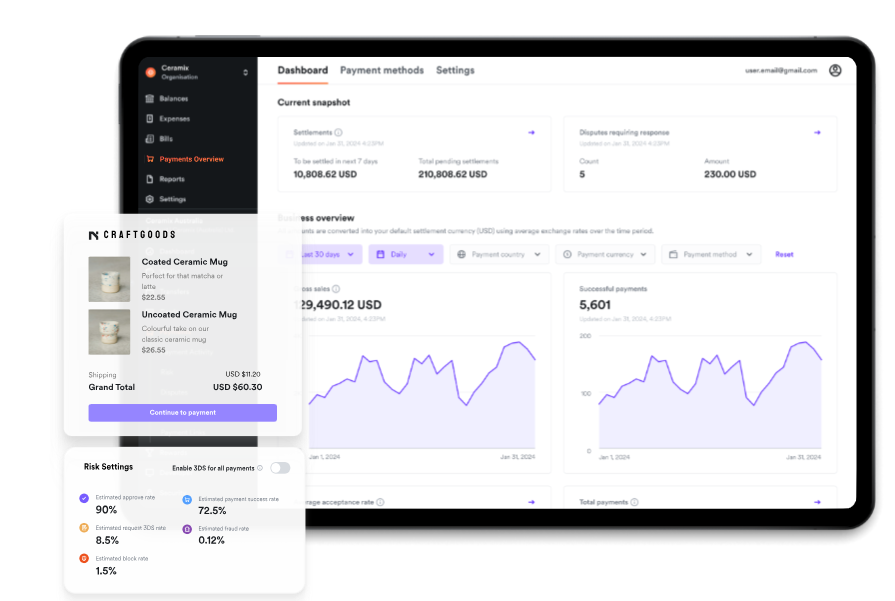

Airwallex is a modern global financial platform designed for businesses that operate internationally. Instead of juggling multiple banks, payment providers, and expense tools, Airwallex brings everything together into one streamlined system.

With Airwallex, U.S. businesses can:

- Open global business accounts

- Accept international payments

- Send cross-border transfers efficiently

- Issue corporate cards for teams

- Automate billing and subscriptions

- Gain full visibility over cash flow and expenses

The result is simpler operations, lower fees, and faster growth.

Core Products That Make Airwallex Stand Out

Global Business Accounts

Airwallex allows businesses to open multi-currency accounts without the complexity of traditional international banking. You can receive, hold, and manage funds in multiple major currencies, making it easier to work with overseas customers, suppliers, and partners.

This is especially valuable for U.S. companies selling internationally or managing global revenue streams.

International Payments with Competitive FX Rates

One of Airwallex’s biggest advantages is its pricing. Businesses benefit from transparent foreign exchange rates and reduced transfer costs compared to traditional banks. Transfers are processed quickly, helping companies improve cash flow and avoid delays that impact operations.

Corporate Cards for Smarter Spending

Airwallex offers both physical and virtual corporate cards that can be issued instantly. Businesses can:

- Set spending limits per card or employee

- Track expenses in real time

- Reduce reimbursement headaches

- Improve control over company spending

This is ideal for growing teams, remote employees, and departments with ongoing operational costs.

Built-In Expense Management

Every transaction is automatically tracked and categorized, making expense management far more efficient. Finance teams can see where money is being spent, reduce errors, and simplify month-end reporting.

Billing and Subscription Management

For SaaS companies and service providers, Airwallex simplifies invoicing, recurring billing, and subscription payments. Automated billing reduces manual work, improves accuracy, and helps businesses get paid faster.

Seamless Platform Integrations

Airwallex integrates smoothly with popular accounting, ERP, and e-commerce platforms. This allows businesses to automate reconciliation, reduce data entry, and maintain accurate financial records without extra effort.

Exclusive Benefits and Promotions for U.S. Businesses

Airwallex customers in the United States gain access to a range of exclusive business perks and savings, designed to help companies grow faster while keeping costs low.

Key benefits often include:

- No monthly account maintenance fees

- Access to valuable partner discounts on essential business tools

- Credits and savings on cloud services, productivity software, and e-commerce solutions

- Special offers related to financing and growth support

What Real Customers Say About Airwallex

Airwallex consistently receives strong feedback from businesses that rely on global payments and multi-currency operations.

Customers frequently highlight:

- Significant cost savings on international transactions

- Faster payment processing compared to traditional banks

- Easy-to-use dashboard and intuitive interface

- Reliable corporate card and expense management tools

Many users report that switching to Airwallex helped them simplify their financial stack and reinvest savings back into marketing, hiring, and expansion.

Who Should Use Airwallex?

Airwallex is particularly well-suited for:

- E-commerce brands selling internationally

- SaaS companies with global customers

- U.S. startups planning overseas expansion

- Agencies paying international contractors

- Businesses managing multi-currency revenue

If your company moves money across borders, Airwallex can dramatically reduce friction and improve efficiency.

Why Airwallex Is a Smart Choice in 2026 and Beyond

As global commerce continues to grow, businesses need financial infrastructure that keeps up. Airwallex combines technology, transparency, and flexibility — helping U.S. businesses compete on a global scale without the limitations of traditional banking.

By unifying payments, cards, billing, and expense management in one platform, Airwallex allows companies to focus on growth instead of financial complexity.

Final Verdict: Is Airwallex Worth It?

For U.S. businesses looking to streamline global payments, reduce costs, and gain full control over their finances, Airwallex is a powerful and future-ready solution.

It delivers:

- Lower international transaction costs

- Faster global payments

- Better financial visibility

- Scalable tools for growing teams